iowa state income tax calculator 2019

This page has the latest Ohio brackets and tax rates plus a Ohio income tax calculator. Minnesota Department of Revenue.

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Income tax tables and other tax information is sourced from the Ohio Department of Taxation.

. Like the IRS states typically use a special form for an amended return. Refund Status By State. If you want to compare all of the state tax rates on one page visit.

Age 65 or Older or Disabled Subtraction Missouri Department of Revenue. Seven State of Iowa agencies are preparing to add functionality to GovConnectIowa the States secure online tax portal to make it easier to do business in Iowa and to better serve Iowas taxpayers. Those states have reciprocity agreements with Illinois.

First fill out an amended federal income tax return Form 1040-X. IDR has issued new income withholding tax tables for 2022 including an updated withholding calculator. How Income Taxes Are Calculated.

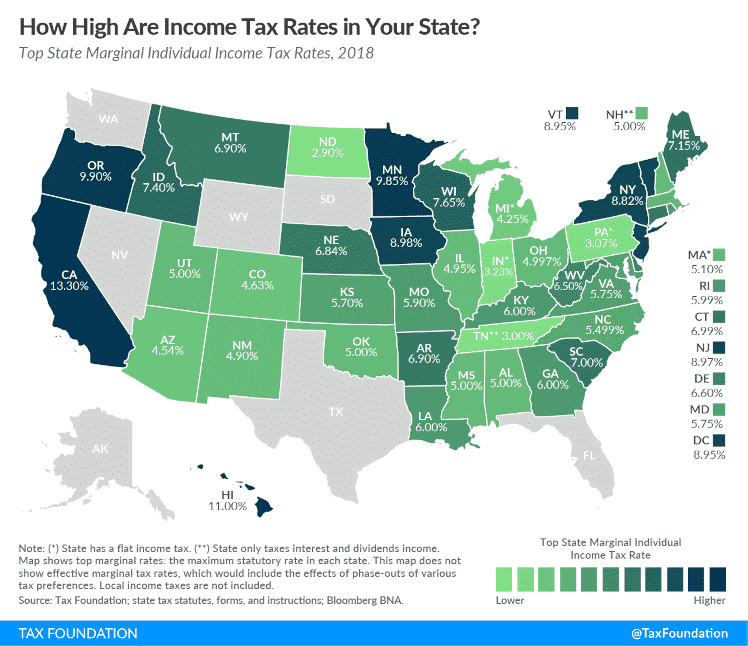

Choose any state from the list above for detailed state income tax information including 2022 income tax tables state tax deductions and state-specific income tax calculators. Offer valid for returns filed 512020 - 5312020. The Salary Calculator for US Salary Tax Calculator 202223 - Federal and State Tax Calculations with full payroll deductions tax credits and allowances for 2022 and 2021 with detailed updates and supporting tax tables.

Calculating your Oregon state income tax is similar to the steps we listed on our Federal paycheck calculator. Income is pre-tax gross income earned between January and December. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year.

The state of Florida imposes a corporation tax on all corporations conducting business or earning income within the state at the following tax rates. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income. Get HR Block 2019 Back Editions tax software federal or state editions for 2019.

You can amend your state tax return in two simple steps. Income-Contingent Repayment ICR caps payments at 20 of discretionary income and. Second get the proper form from your state and use the information from Form 1040-X to help you fill it out.

Figure out your filing status. Revised Pay As You Earn REPAYE is also 10 of your discretionary income and provides forgiveness after 20 years 25 years for borrowers with grad school debt. Average income by state for households or individual workers plus the median income and top 1 incomeIts the newest data to this point in 2022.

South Carolina Paycheck Calculator. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. The Federal Tax Calculator below is updated for the 202223 tax year and is designed for online calculations including income tax with Personal allowance refundable non-refundable tax credits Federal Tax State Tax Medicare Social Security and Yearly Income Tax deductions we also have State Tax calculators available for each state.

How do I amend my state tax return. Start tax preparation and filing taxes for 2019 with HR Block 2019 Back Editions. Michigans tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living.

Iowa Kentucky and Michigan. No cash value and void if transferred or where prohibited. No state-level income tax if you earn less than 3070 per year.

Many state pages also provide direct links to selected income tax return forms and other resources. 2019 and has an advanced manufacturing industry with industrial outputs include textile goods chemical products paper products machinery etc. If not your South Carolina income tax ranges from 3 to 7.

Ohios 2022 income tax ranges from 285 to 48. 1 9 Tax credit projects located in a rural area as defined in section 520 of the Housing Act of 1949 are eligible to use the greater of area median gross income or national non-metropolitan median income as allowed under the Housing Act of 2008 for rent and income determinations after the July 30th enactment date of the Housing Act of 2008. 2019 Missouri Income Tax Refence Guide Page 6.

Heres what you need to know about the Illinois state income tax from the states flat tax rate to available deductions credits and exemptions. Kansas 2019 Income Tax Page 17. Your household income location filing status and number of personal exemptions.

So the tax year 2022 will start from July 01 2021 to June 30 2022. In this post find household income by state and individual income by state statistics for the United States in 2021Find all your favorite summary statistics. Kansas Department of Revenue.

Taxability of Social Security Benefits for Connecticut Income Tax Purposes Page 1. Iowa State Refund Status Kansas State Refund Status Kentucky State Refund Status. Valid for an original 2019 personal income tax return for our Tax Pro Go service only.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Michigans income tax rates were last changed ten years prior to 2020 for tax year 2010 and the tax brackets have not been changed since at least 2001. This page provides detail of the Federal Tax Tables for 2019 has links to historic Federal Tax Tables which are used within the 2019 Federal Tax Calculator and has supporting links to each set of state.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. And it did so again for the 2019 and 2020 tax years. The 2021 form continues to have AGI on line 11.

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

County Surcharge On General Excise And Use Tax Department Of Taxation

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets Tax Foundation

Taxation Of Social Security Benefits Mn House Research

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

529 Plans The Best Places To Invest Your Education Savings Clark Howard 529 College Savings Plan 529 Plan How To Plan

Is Social Security Taxable Estimated Tax Payments Social Security Income

Tax Calculator Estimate Your Taxes And Refund For Free

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2022 Property Taxes By State Report Propertyshark

Which States Pay The Most Federal Taxes Moneyrates

Iowa Income Tax Calculator Smartasset

Do I Need An Out Of State Attorney Dads Divorce Child Custody Spring Break Idioms